Weekly Crypto Market Report from DCAUT(Dec 1st)

Weekly Crypto Market Report from DCAUT(Dec 1st)

Published on: 12/5/2025

1. Innovation Sector: The "Lego Moment" for AI Agents & PayFi

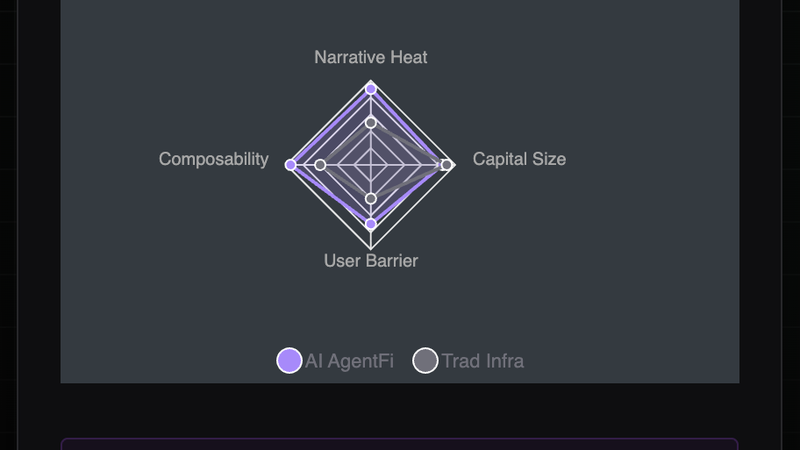

The focus in the primary market and on-chain innovation has shifted from infrastructure (Infra) to application-layer composability.

AI AgentFi (AI-Driven Finance): On-chain AI has evolved beyond Memes into the DeFi execution layer. The trend is AI Agents autonomously managing funds for high-frequency arbitrage and liquidity mining. This marks a paradigm shift from "Human-to-Contract" to "AI-to-Contract" interaction.

PayFi (Payment Finance): With stablecoin compliance looming, RWA-based Cash Flow Factoring projects are emerging on Solana and Base. This represents a tangible use case of TradFi leveraging Web3 for cost reduction and efficiency.

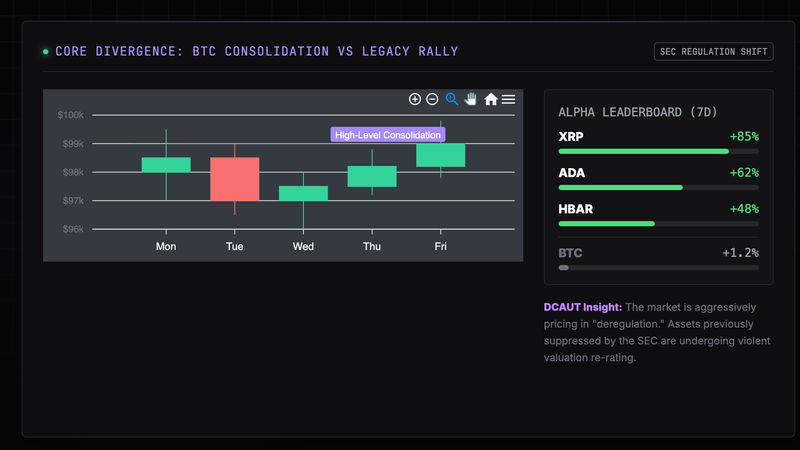

2. Major Coins: Bitcoin’s Consolidation is the Altcoin’s Carnival

BTC: Currently in a high-level consolidation and accumulation phase. While ETF inflows have slowed, on-chain sell pressure is negligible. This sideways movement creates a Golden Window for Altcoins.

ETH: The ETH/BTC pair shows signs of a bottom rebound. As an "Internet Bond," its staking yield is regaining attractiveness in a rate-cut cycle, with Smart Money re-accumulating ETH as an interest-bearing asset.

XRP/ADA/HBAR (Legacy L1s): The week’s strongest Alpha. The logic is crisp: "The Disappearance of the Regulatory Discount." As expectations for the SEC’s stance shift, these assets—previously labeled "securities"—are undergoing severe Valuation Repair (Re-rating). This is a textbook Wall Street "Distressed Asset Reversal" strategy.

3. DeFi Sector: The Victory of Derivatives & Liquidity

Perp DEX: Following the massive wealth effect from the Hyperliquid TGE, on-chain derivatives volume has surged. The market realizes that order-book exchanges on high-performance chains are substantially cannibalizing CEX market share.

Yield Aggregation: Capital is rotating from simple Lending protocols to structured products, specifically "Delta Neutral" strategies. On-chain capital is becoming "smarter."

4. Meme Coins: Divergence After Peak PVP

The Meme market is undergoing a brutal Attention PVP (Player vs. Player) cycle.

Phenomenon: The pure "Zoo" (animal) narrative is failing, with lifecycles compressing to mere hours.

Alpha Direction: Capital is chasing "AI Religion" (tokens issued by AI-controlled social accounts) and "Web2 Virality" (TikTok trends). From a Wall Street view, Memes are a Monetized Sentiment Index—only assets with deep cultural penetration or AI backing can survive this week's volatility.

5. Binance Alpha & Chain Landscape

- Binance Alpha: Recent listing strategies clearly favor projects with "High User Retention," specifically Gaming and Social apps that maintained high DAU during the bear market. The signal: Real users are the only moat for the next cycle.

- Public Chains & L2:

- Base: Leveraging Coinbase as an entry point, it is becoming the "On-chain Stock Market" and SocialFi hub, siphoning massive EVM liquidity.

- Solana: Remains the battlefield for HFT and the Meme Casino. However, network congestion is concerning DeFi whales, showing signs of capital spillover to high-throughput L2s (e.g., the MegaETH narrative).

💡 Analyst Recommendation (Next Step)

The market is in a "Greedy yet Confused" state. For retail investors, the risk-reward ratio for chasing rallied legacy coins (like XRP) has diminished.

Would you like me to... Deep dive into the Hyperliquid ecosystem or the AI AgentFi sector, analyzing their specific economic models and potential entry points?

© 2025 DCAUT. All rights reserved