Vindicating Martingale: 300-Year-Old Famous Strategy

Vindicating Martingale: 300-Year-Old Famous Strategy

Published on: 12/18/2025

I. The Verdict: Martingale Isn't for Fools; Fools Use Martingale Brainlessly

In trading circles, "Martingale" is often a synonym for financial suicide. Mention it on any forum, and the backlash is predictable:

- "Say goodbye to your account."

- "Gambler's Fallacy. Did you fail middle school math?"

- "Just another lamb to the slaughter."

However, a curious paradox exists: this strategy has survived for 300 years. Even more telling is that if you peek into the strategy libraries of professional quantitative teams, eight out of ten will have "Martingale DNA" hidden inside.

This leaves two possibilities: either every professional team in the world is foolish, or those bashing Martingale don't actually understand it. I lean toward the latter.

II. What Exactly Is Martingale? (In Plain English)

The core logic is brutally simple: Double your bet after every loss until you win, at which point you recover all previous losses plus a profit.

Example:

- Bet $100, Lose.

- Bet $200, Lose.

- Bet $400, Win.

- Result: You win $400. Total previous losses were $300 ($100+$200). Net Profit: $100.

It sounds flawless: no matter how many times you lose, one single win recoups everything. The Catch? What if the losing streak continues?

By the 10th round, you must bet $51,200. By the 20th? Over $50 million.

This is why it’s hated: it works in theory with infinite wealth, but in reality, your capital is finite. Most people stop here and conclude: Martingale = Death. But what if we stop chasing the "guaranteed win"?

III. A New Perspective: The Problem Isn't the Strategy; It's Greed

Traditional Martingale relies on a pathological assumption: "I must win eventually, no matter how many losses it takes." No strategy—Martingale or otherwise—can guarantee a win.

But what if we change the assumption?

Instead, say: "I will double my bet a maximum of 5 times. If I lose the 5th time, I take the loss and walk away."

What happens then?

- Your Maximum Drawdown becomes a fixed number ($100+$200+$400+$800+$1,600 = $3,100). It doesn't explode infinitely.

- The probability of winning at least once within those 5 attempts is statistically very high.

This isn't a "magic bullet," but it isn't "suicide" either. It becomes a normal trading strategy with calculated risks. If your hit rate is over 50%, you can be profitable in the long run.

The Distinction:

- Infinite Martingale: "I must win at all costs" $\rightarrow$ Certain Bankruptcy.

- Limited Martingale: "I have a hard stop-loss at X steps" $\rightarrow$ A Legitimate Strategy.

The former is what people hate; the latter is what pros quietly utilize.

IV. The Essence: A Rhythm of Position Sizing

Think of Martingale as a "recovery" mindset with one rule: "I will lose no more than $3,000 tonight."

- The gambler without this rule chases losses until they are broke.

- The trader with this rule accepts a $3,000 loss today but returns tomorrow.

Martingale is not a "holy grail"; it is a position-sizing rhythm. It amplifies your edge when you are right and uses a hard stop-loss to cap your downside when you are wrong.

The two prerequisites: A win rate > 50% and a strict stop-loss. Without both, Martingale is a meat grinder.

V. Why Do So Many People Lose Money With It?

- Overestimating Accuracy: Martingale requires a baseline win rate of > 50%. Most traders feel they are right 60% of the time but are actually right 40% of the time. In that case, Martingale simply accelerates your demise.

- Lack of Discipline: They promise to stop at the 5th double, but when that loss hits, they "double just one more time" out of desperation. That is when the account vanishes.

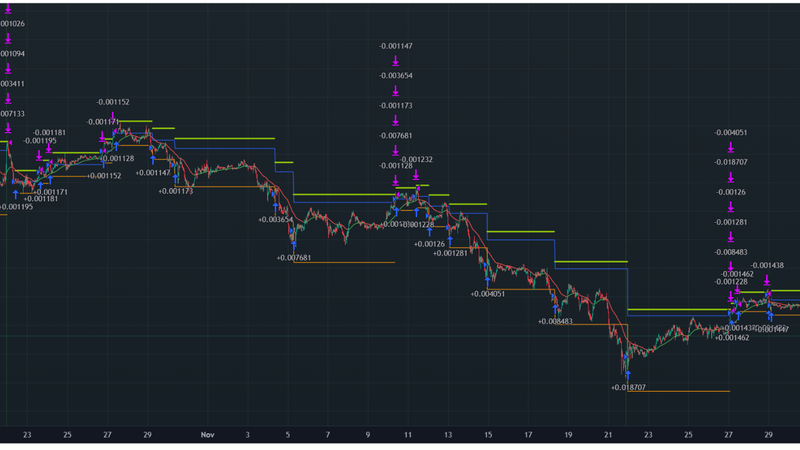

- Wrong Market Conditions: Martingale thrives in mean-reverting (ranging) markets. It is decimated by strong trends (one-way moves) that never pull back to hit that "one win."

VI. Can You Use It?

Yes, but only if you meet these three conditions:

- Predictive Edge: Your entry accuracy must be $> 50\%$. If you can't pick a direction, no strategy can save you.

- Ironclad Stop-Loss: Decide the maximum number of "steps" beforehand. If you hit the limit, accept the loss. No exceptions.

- Market Selection: Use it in oscillating markets; stay away during clear trending phases.

VII. Final Thoughts

Martingale has been misunderstood for 300 years because people see the "doubling down" but ignore the "hard cap."

A kitchen knife is a tool; in the hands of a madman, it’s a weapon.

- A gambler uses Martingale to find a "sure thing" and finds ruin.

- A trader uses Martingale as a disciplined tool to manage equity.

Next time someone tells you "Martingale is a death trap," ask them: "Are you talking about the infinite gambler's version, or the risk-managed professional version?" They share a name, but their DNA is entirely different.

Disclaimer: Trading involves risk. This article does not constitute investment advice.

Would you like me to help you calculate the specific win probabilities for a limited Martingale sequence based on different win rates?

© 2025 DCAUT. All rights reserved