Guiding Tutorial of DCAUT

Guiding Tutorial of DCAUT

Published on: 12/26/2025

Part I: Core Strategies & Conceptual Encyclopedia

1. Martingale Strategy

The mathematical foundation of DCAUT’s position management. It lowers the average entry price by increasing capital allocation as the market moves against the position.

- Mathematical Logic: A specific percentage of price retracement allows the entire position to exit in profit.

- DCAUT Optimization: Unlike traditional Martingale, we use ATR Dynamic Spacing and Indicator Protection to prevent the risks of infinite scaling.

2. Grid Strategy

Engineered for sideways/oscillating markets. The system divides capital into equal segments across a price range, executing "buy low, sell high" at predefined gradients.

- Volatility Arbitrage: Captures micro-spreads within a range to achieve compounded growth.

3. Enhanced DCA (The Flagship Feature)

A premium strategy utilizing intelligent algorithms to sense market volatility. It solves the primary pain point of traditional DCA: exhausting capital too early during a vertical crash.

- Perception Logic: Integrates price action with technical indicators like RSI and Bollinger Bands.

- Delayed Entry: If the price drops but momentum remains bearish, the algorithm defers safety orders until a stabilization signal is detected.

- Advantage: Significantly reduces capital costs and achieves a much lower average position price than competitors.

4. ATR Take-Profit (Average True Range)

ATR measures market volatility.

- Dynamic Adjustment: Instead of fixed percentages, ATR Take-Profit expands or contracts targets based on the market’s activity over the last $N$ periods.

- Scenario: Captures larger moves during high volatility and secures profits quickly during low volatility.

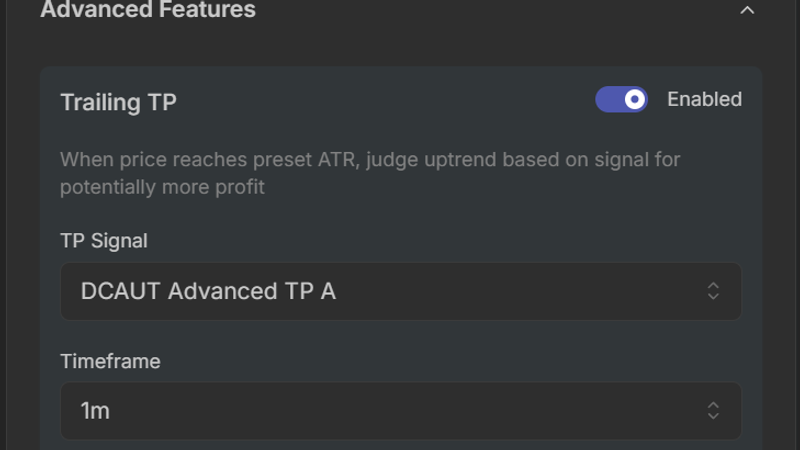

5. Trailing Take Profit

An advanced tool designed to maximize the Profit/Loss (P/L) ratio during strong trends.

- Logic: Once the Take-Profit target is hit, the bot enters "Trailing Mode" instead of closing immediately.

- Profit Maximization: The exit line moves up with the price. The position only closes if the price retraces by a set percentage (e.g., 0.2%) from its peak.

6. Multi-Timeframe Signals

Core Principle: Set the signal timeframe based on your desired trading frequency.

- Hybrid Execution: DCAUT allows mixing timeframes within a single strategy.

- Segmented Processing: Use short cycles (5m–15m) for initial orders to capture quick scalps, and long cycles (1h–2h) for deep safety orders.

- Risk Control: Large capital injections are only triggered when long-term signals confirm a market bottom.

Part II: Key Parameters & Configuration

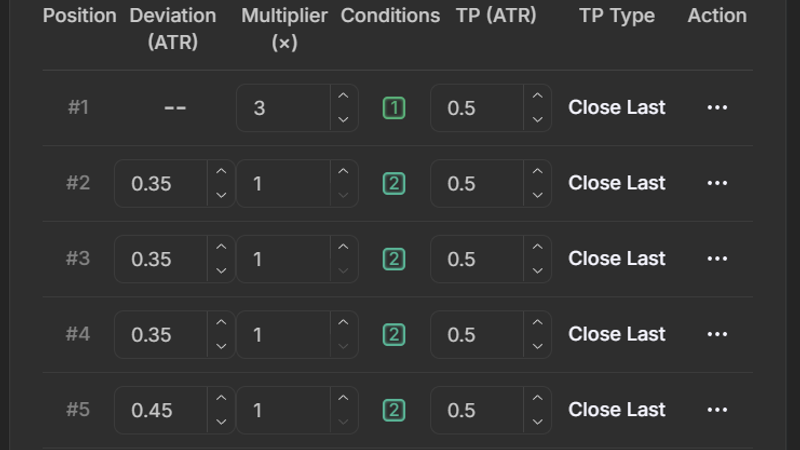

Parameter Definition Impact Order Multiplier

The scale of subsequent safety orders.

A 1.5x multiplier means a 100U start followed by a 150U order. Speeds up break-even but increases margin demand.

Price Deviation

The distance between subsequent orders.

A 1.1x deviation widens the gap between orders (e.g., 1%, then 1.1%). Extends strategy longevity during deep crashes.

Risk Coefficient

A value derived from leverage, order count, and capital utilization.

Higher coefficients indicate a higher liquidation risk. Keep this within a safe range via backtesting.

Trend vs. Volatility

Strategy modes for specific market conditions.

Trend: Holds positions until the trend breaks. Volatility: Rapidly cycles through trades for liquidity.

Part III: Step-by-Step Operations

Step 1: Environment Setup

- Exchange Connection: Link your exchange (Binance/OKX) via API. Ensure "Enable Spot/Futures Trading" is checked and IP Whitelisting is configured.

- Mode Selection: * Novice: Use "Best Practices" on the left to apply expert-verified "Conservative" or "Aggressive" templates with one click.

- Advanced: Use the right-hand panel for full custom configuration.

Step 2: Logic Configuration

- Base Order: Define your initial entry size.

- Conditions (Signals): This is DCAUT’s core edge. Enable this to ensure safety orders trigger based on Technical Signals (e.g., RSI Oversold) rather than just price drops.

- Nesting: Assign different resolutions (15m, 1h, 4h) to different layers of your safety orders.

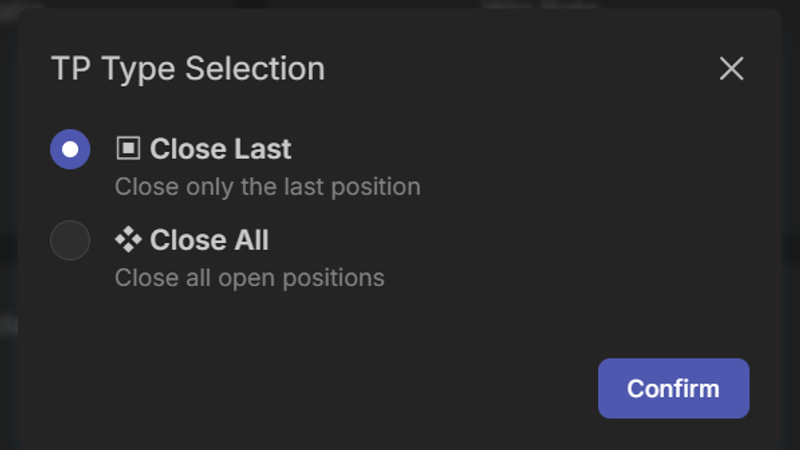

Step 3: Exit Strategy

- Set Target Profit: Input your desired ATR-based profit target.

- Enable Trailing: Turn on Trailing Take Profit to capture trend extensions.

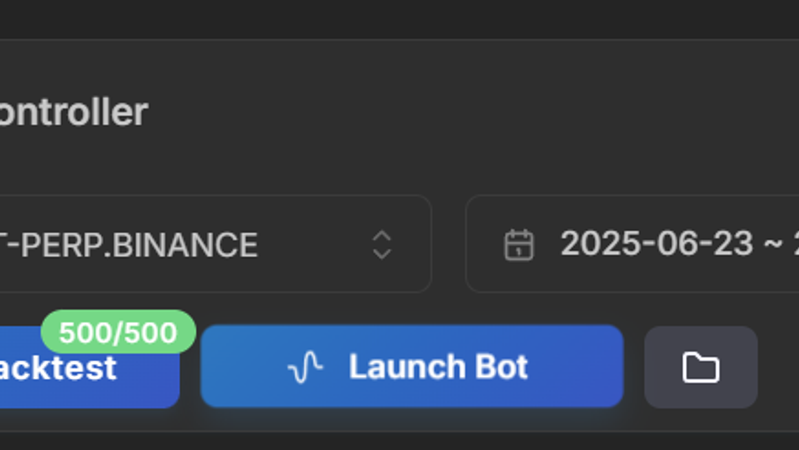

Step 4: Full Data Backtesting (Crucial)

Never deploy without backtesting.

- Run the strategy against historical K-line data.

- Evaluation: Check the PnL Curve. If the Max Drawdown (MDD) exceeds your risk tolerance, increase your "Price Deviation" or "Safety Order" count.

Step 5: Live Deployment

- Compliance: Ensure KYC is complete and your membership is active.

- Self-Check: The system automatically verifies API status and subscription levels.

- Launch: Click "LAUNCH BOT" to transition from the test environment to live automated execution.

Part IV: Risk Management & Competitive Edge

Why Choose DCAUT?

- Superior Capital Efficiency: The Enhanced DCA algorithm prevents capital from being wasted during the middle of a crash, concentrating it at the point of reversal.

- Lower Cost Basis: Intelligent safety orders keep your average price closer to the market price, allowing you to exit "underwater" positions up to 30% faster.

- Institutional UX: Complex quantitative logic is distilled into a clean, intuitive dashboard.

- Regulated & Compliant: DCAUT provides a secure, compliant foundation for both capital safety and strategy execution.

Technical Disclaimer:

While quantitative trading models reduce risk, they cannot eliminate systematic market risk. Users should fully understand all parameters, conduct thorough backtests, and trade according to their financial capacity.

© 2026 DCAUT. All rights reserved